Home | Previous | Next Lesson

This Lesson Can Be Printed See Instructions Below

Neal Hughes "FibMaster"

We are indeed fortunate in this lesson to have Neal Hughes give some of his time and explain some of the basics of Fibonacci trading.

Neal has taught Fibonacci trading methods for many years to private clients and small groups.

Neal is well versed in all aspects of technical analysis. He is also an accomplished programmer and has written many market related software applications and custom indicators.

He is one of my favorite traders and is highly respect throughout the industry.

by Neal Hughes

First, a few words about Fibonacci himself…

Leonardo Pisano (nickname Fibonacci) was a mathematician, born in 1170, in Pisa (now Italy). His father was Guilielmo, of the Bonacci family. His father was a diplomat, as a result Fibonacci was educated in North Africa, where he learned "accounting" and "mathematics".

Fibonacci also contributed to the science of numbers, and introduced the "Fibonacci sequence"

The Fibonacci sequence is the sequence 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, introduced in his work "Liber abaci" in a problem involving the growth of a population of rabbits. Aside from this sequence of number where every next number is the sum of the proceeding two, 0, 1 (0+1), 2 (1+1), 3 (2+1), 5 (3+2), 8 (5+3), 13 (8+5), etc. There are the "Fibonacci ratios".. By comparing the relationship between each number, and each alternate number, and even each number to the one four places to the right, we arrive at some fairly consistent ratios.. The important ones are .236, 50, .382, .618, .764, 1.382, 1.618, 2.618, 4.236, and for good measure we include 1.00 ..

|

It turns out that the ratios are mathematical principles prevalent in nature around us, and is also in man-made objects. There are many interesting, entertaining, and poetic observations about Fibonacci numbers and ratios in the universe (see the reference section below). Fibonacci numbers appear in ancient buildings, in plants, planets, molecules, the dimensions of human bodies, and of course snails… But of what use is all that to the lowly trader?

What really interests you, the application of Fibonacci techniques in the trading environment..

Traders usually study charts! Fibonacci ratios may be applied to the Price scale, and also to the time scale of charts. I study the price scale. My focus here will be on the price scale for now, perhaps in the future I'll add some time-scale studies.

Prices never move in a straight line. Look at any chart, you will see many wiggles, as price advances and retraces.. Stocks, Futures, Forex, all instruments which are liquid, will often retrace in Fibonacci proportions, and advance in Fibonacci proportions. Not always, and not precisely to the penny. But very often, and reasonably close! This happens often enough that profitable trades can result. I will show you some examples below.

I used Fibonacci ratios with a few simple indicators to help determine probable price turning points, optimum entry, exit and stop-loss levels. My complete techniques are available in on-line video seminars, in-person seminars, and via my real-time on-line chat facility. For more details, see the following web page: http://www.surefire-trading.com/fibmaster.html

The application of Fibonacci to trading can be very complex, and take much time and experience to perfect. Many traders enjoy making the process as difficult and as complex as they can tolerate.. I do the opposite, I try to simplify, try to bring clarity.

Fibonacci example - Microsoft Weekly chart.

This lesson demonstrates a very basic way to use Fibonacci

levels. You just read about Fibonacci ratios. We will use

just one of those ratios for now, the .382 Fibonacci ratio.

In this chart MSFT made a high of (approximately) $59.97 in

December of 1999. After that, it moved down to make a low

of $30.19 in May of 2000.

The down move was $29.78 (59.97-30.19), quite a substantial amount.

Projecting from that low in May, and using a Fibonacci ratio, we can calculate 29.78*.382=$11.37 . So 38.2% of 29.78 is 11.37 . If MSFT were to rally 38.2% of the down-move it would reach $41.57 (11.37+30.20). I'm using rounded numbers in my calculations, the chart above calculates it to be $41.564, we don't need that degree of accuracy!

Several weeks later, MSFT rallied and resisted right near that .382 Fibonacci level !!

So we were able to predict a future probable turning point (after the low of May 2000), using the Fibonacci ratio of .382!! If only it were always so easy.

The steps involved are:

- Calculate the total value of a significant price-move (high to low, or vice-versa).

- Calculate a Fibonacci retracement (in this case .382) of the prior move.

- Look for price to confirm, by resisting (or support in an up-move) near that predicted retracement area.

Fibonacci example - Microsoft Daily chart.

This chart shows how a different Fibonacci level (61.8%) predicted

resistance and a market turn.

Notice how the market behaved at the .382 level (30.80 area). Initially the market spiked through, then fell back to that level (late October). We cannot expect a chart to retrace at every Fib level. We can expect some support/resistance as buyers/sellers enter the market at these levels, but we can't always predict whether the market will actually turn at any particular level. Fibonacci techniques are used to alert you to a possible trade, if that price level does cause support or resistance. These techniques are not used as a trigger for entry. Other indicators are used in conjunction with Fibonacci studies to provide higher-probability entries..

As mentioned before, there are several Fib levels, .236, 50, .382, .618, .764, 1.382, 1.618, 2.618, 4.236, and 1.00 .. So there are several places to look for a market turn. They can be calculated in advance, but trading blindly at a fib level can be dangerous, because you never know for certain (in advance) whether the market will turn at any particular Fib level. I use other indicators to help overcome that problem, click here to learn how to determine which Fib ratio is likely to be strong enough to turn the market.

Important notes from this lesson:

- There are several Fib levels.

- It takes some skill to determine which Fib level is likely to cause the market to turn.

- There are some techniques to help you determine where a market is more likely to turn.

- Do not blindly anticipate a market turn at a Fib level.

More Fibonacci examples.

QQQ Weekly chart with a deep retracement to .618 and a weak attempt to rally after that. However, consider the daily chart and intraday traders. they would have enjoyed the rally from $75 to $100, after going long from a support level that could have been predicted in March!

QQQ daily chart. Multiple Fib levels timing the market perfectly in 3 consecutive waves up!

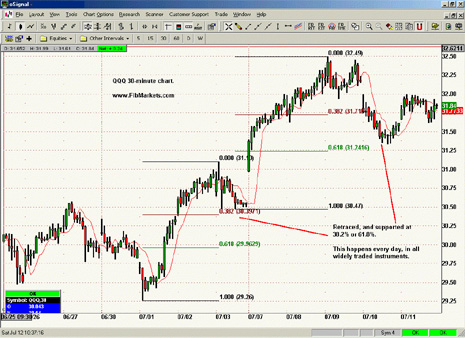

Intraday chart, QQQ 30-minute. Notice the two market Fib retracements (there are others in this chart too).. The rally from 29.26 stopped at 31.10, then it supported **twice** at 30.39, for two good scalps. The next highlighted Fib support is at a retracement of .618 from the move up 30.47 to 32.49 .. Both of these support levels were predictable before the market supported there.. Hint:--- See how the rally continued after the shallow retracement to 30.39 ... See how the rally after the deeper retracement to .618 near 31.25 was a weaker rally.. This is common, a deeper retracement often foretells a weaker rally... See the next lesson in the table of contents for more on these advanced Fibonacci trading principles.

Another intraday chart, S&P 5-minute.. The

first Fib retracement is on a bearish move, an opportunity

to short. The second is bullish, with a long entry near 999.25

.. Note that popular charting software will calculate Fibonacci

to rediculous precision, we don't need anything closer than

one tick! Actually, you should allow some room don't expect

precision every time. Allow the trade some room to develop,

or you will be stopped out too often.

More Advanced - Microsoft Daily chart.

By now you're probably quite interested, perhaps applying

all those Fibonacci ratios to many charts.. You should experiment

with your own charts. As long as the instrument traded has

a lot of liquidity (not a penny stock for example), you should

start to see Fib support and resistance at work. You will

start to notice that Fibonacci levels "work" sometimes

and not others. Sometimes the trades are not profitable, or

are less profitable than others. You need to develop the skills

required to select better trades.

In this mini-lesson I want to show you how to evaluate price

action based on which Fib levels it responds to, and how the

market behaves immediately preceding the Fib support/resistance.

The chart below actually has many Fibonacci levels "performing well", providing support or resistance to the market. I want you to focus on the two that I have identified, for the purposes of this lesson.

The first up-move that I have identified topped out at $26.90, and then retraced 61.8% before supporting at that Fib level. There was a pause at the .382 level, but it was not sufficient to hold the market. Now look at the rally from the support level near .618, it rallied but did not exceed the prior high of 26.90 … As a general rule, a retracement to .618 or below indicates that the preceding up-move is losing steam. A shallow retracement which supports at .382 is more likely to rally beyond the prior high than one which has a deep retracement beyond .50 all the way to .618 ..

The impressive thrust from 22.55 up to 26.90 was negated by a quick move back to .618 at about 24.20, so a trader should not be too optimistic about a continuation of the initial up-thrust.

Similarly, the move up in June, from 23.50 to almost 26.50 would also not inspire much optimism for a huge rally above the high of 26.50 … In general a shallow support at .382 would indicate a probable rally beyond the prior high. However, if the up-move preceding the retracement was sluggish rather than thrusting, you also should temper your enthusiasm.

If the second rally which only retraced to .382 had the thrust of the first rally, it would be a more attractive trade!

These are not firm rules, instead they are used as a guide, to help you filter for better trades. Every Fib level is not equal, some are more attractive than others.

Important notes from this lesson:

- Not all Fib levels are alike.

- No technical study is perfect, you must develop the skills to filter out bad trades, and improve the odds of finding better trades.

- Price action just before a Fib retracement can tell you something about the future.

- Which Fib level causes the end of a retracement also can give a hint to future price action.

- No technical study is perfect, you must develop the skills to filter out bad trades, and improve the odds of finding better trades.

You can learn more about Neal and his video course by clicking here.

Website - www.fibmarkets.com

Email - members@fibmarkets.com

Good Trading

Best Regards

Mark McRae

Information, charts or examples contained in this lesson are for illustration and educational purposes only. It should not be considered as advice or a recommendation to buy or sell any security or financial instrument. We do not and cannot offer investment advice. For further information please read our disclaimer.

![]() To PRINT or save a copy of this lesson in PDF format simply click the PRINT link. This will open the lesson in a PDF format which, you can then PRINT. If you are unfamiliar with PDF or don't have a FREE copy of Arobat Reader see instructions.

To PRINT or save a copy of this lesson in PDF format simply click the PRINT link. This will open the lesson in a PDF format which, you can then PRINT. If you are unfamiliar with PDF or don't have a FREE copy of Arobat Reader see instructions.