Home | Previous | Next Lesson

This Lesson Can Be Printed See Instructions Below

One Simple Thing That Can Improve Your Trading

I am going to share with you a simple discipline that can really help your trading. This simple little act is often ignored by new traders and overlooked by experienced traders.

Here's what brought me this subject. Whilst discussing the markets with one of my students he was trying to justify a position in the market he had. This particular trader was an intraday trader who normally trades off a 1 minute and 5 minute chart. His typical style of trading was to try and catch the early stage of a trend. During our discussion I asked him this simple question. What is the market doing right now? His reply was that it was doing nothing, it was flat. Herein lies the crux of the matter. Even though new traders have taken a course or read bundles of books. They know good money management principle and have a good method to apply to the markets; they still feel compelled to trade a market that doesn't fit their criteria. |

Here's what brought me this subject. Whilst discussing the markets with one of my students he was trying to justify a position in the market he had. This particular trader was an intraday trader who normally trades off a 1 minute and 5 minute chart. His typical style of trading was to try and catch the early stage of a trend.

During our discussion I asked him this simple question. What is the market doing right now? His reply was that it was doing nothing, it was flat. Herein lies the crux of the matter.

Even though new traders have taken a course or read bundles of books. They know good money management principle and have a good method to apply to the markets; they still feel compelled to trade a market that doesn't fit their criteria.

Experienced traders get so involved with the market and are so close to what they are trading they forget to take a step back and ask. What is the market doing right now? They often feel so in tune with the market they forget to look at the big picture.

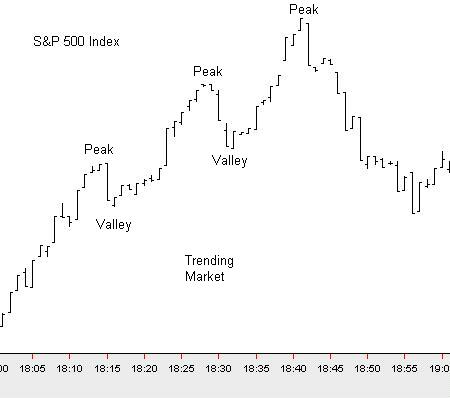

See Chart Below

A trader wakes up each day with the assumption that he will do his best to take some profit from the market. He sits down at his computer screen and starts looking for opportunities or tries to apply his predefined rules for entry and exit.

Because he has gone through this process he is psychologically trying to fit the market into his assumption that there is an opportunity when in fact there is not.

Let me give you an example. The student I mentioned earlier was so keen to get into the market that he had convinced himself that a trend had started when in fact there was no trend there. He had been staring at the computer screen so long, watching every tick that when there was a slight movement in the market he was on it.

As I mentioned earlier this particular trader liked to try and catch a trend. What I suggested he do is printout the chart he was looking at then go for a cup of coffee. Take 10 minutes out and then come back to his printout of the chart and honestly ask himself if the market was trending or not.

By just taking a step back from the situation and looking at the market action realistically it was obvious the market was not trending and there was in fact no opportunity at present.

I have seen trader take four or five steps away from the computer screen just to get a different perspective on the chart. Try it. Take a chart of the security you are trading, make it so that you have as much data as possible on the screen and then take a few steps away from the computer screen and have a look. You might be surprised!

I mention this mainly for the benefit of new traders because they have a tendency to throw out everything they have learned when dealing with their own money in a live market.

As the trader becomes more experienced they get better at

applying money management rules and disciplining themselves

to stick to there predefined method.

The other side of the coin is the experienced trader who has

become so involved with analysis and levels that he is convinced

that a particular level will hold and the market is about

to move in his anticipated direction.

We can never control or accurately predict where the market will go. All we can do is exploit certain situation in the market as they happen. If we are a breakout trader and the market breaks out of a range then we rightly should be on it. If we are trend following type trader and the market is trending then we should be in that trend as soon as we can confirm it.

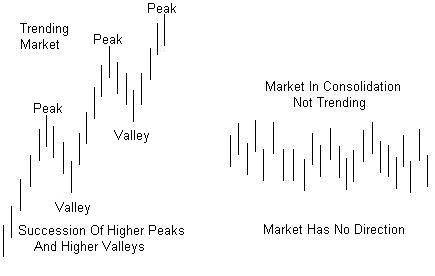

Trading 101

A market that is trending up should have higher peaks and higher valleys. The majority of bars should also have higher highs and higher lows. In a down trend the market should have lower valleys and lower peaks and the majority of bars should have lower lows and lower highs.

See Chart

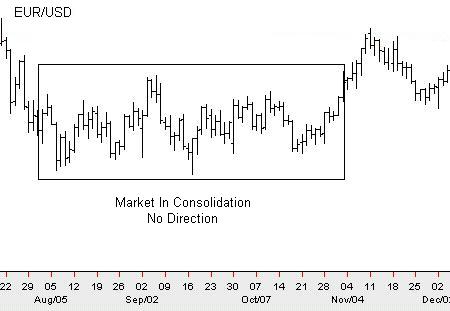

When a market is in consolidation (bracketing/flat) the price will generally oscillate in a broad range. Traders who are watching for the breakout will monitor the security for a qualified break. They may place a straddle traded to catch the move regardless of whether it breaks up or down.

There are traders who specialize in trading consolidation. I don't however recommend it to new traders simply because they get whipsawed too much.

OK, so now we have gone over the basics. Here's the one thing that will help your trading regardless of your level of development. When you start your day the first thing to do when your charts come up is ask yourself this question. What is the market doing right now?

If you are waiting for a breakout or for a confirmed trend and the market is in consolidation, do nothing. This can be hard to accept if you are eager to trade but believe me it will save you a lot of money.

There will be days when there is just no opportunity to trade. There will be times especially after a losing streak that you are just busting to get back in and this is when you have to ask yourself the question. What is the market doing right now? Would it be wiser to just site on the sidelines? Remember that not having a position in the market is a position. You are flat.

We all aspire to become the perfect trader with a well thought

out methodology with good money management and discipline

like iron. The reality is that at some time during your trading

career you will either get into the market when you shouldn't

or you will want to jump in because you are trading off emotions

and not reality.

When that time comes just remember the question!

Good Trading

Best Regards

Mark McRae

Information, charts or examples contained in this lesson are for illustration and educational purposes only. It should not be considered as advice or a recommendation to buy or sell any security or financial instrument. We do not and cannot offer investment advice. For further information please read our disclaimer.

![]() To PRINT or save a copy of this lesson in PDF format simply

click the PRINT link. This will open the lesson in a PDF format which, you

can then PRINT.

If you are unfamiliar with PDF or don't have a FREE copy of

Arobat Reader see instructions.

To PRINT or save a copy of this lesson in PDF format simply

click the PRINT link. This will open the lesson in a PDF format which, you

can then PRINT.

If you are unfamiliar with PDF or don't have a FREE copy of

Arobat Reader see instructions.