Home | Previous | Next Lesson

This Lesson Can Be Printed - See Instructions Below

Trend Lines- Enormous Profits Small Risk

This particular technique requires a little practice and it is something that is well worth looking out for. I call it roofing and flooring. It is best done using a large time scale like a weekly or monthly chart and then lowering the time scale for entry.

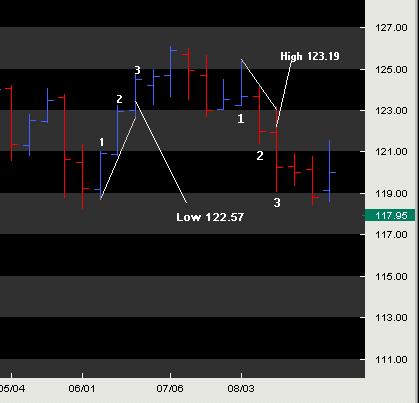

It works like this. First bring up a weekly chart of the market you are following. We are only looking at two bars, any two bars which, we shall call bar 1 and bar 2. You then draw a trend line connecting the bottom of bar 1 and bar 2. From there you extend the trend line into the future (the week coming) and that shall be know as bar 3.

The idea is that in an up trend price will often come back to that very short trend line. As it approaches the trend line of bar 3 you can enter the market with very little risk and massive potential. In the example of the Japanese Yen/US Dollar the low of the bar was 122.57. The trend line came in around 122.60. You could either have entered long at the trend line of 122.60 with a top loss below the trend line at say 122.40 or you could have dropped down to a 5 minute or 15 minute intraday chart to watch price action at this level. The idea is you are only in the trade for 1 bar so you would close out at the end of business on the Friday. In this case the close was 124.50 which, was a gain of 190 pips (Approximately $1526). |

The reverse of this is true for a down trend. Draw a trend line along the highs of bar 1 and bar 2. Extend the line one week forward to find an entry level. The trend line in this case was around 123.00 and the actual high of bar 3 was 123.19. A stop could have been placed at around 123.40 or you could have dropped down to an intraday chart to look for an entry. The actual close of bar 3 in this example was 120.24 if you had entered at 123.00 you would have made 276 pips (Approximately $2295).

If you drop down your time frame you can wait for price to hit the trend line on bar 3 and when it starts to move in your direction jump on board. In an uptrend once you are in you can place your stop below the low of bar 3 and in a down trend you can place your stop above the high of bar 3. See chart below.

Good Trading

Mark McRae

PS. Don't for get to check out our bookstore at http://www.surefire-trading.com/

Information, charts or examples contained in this lesson are for illustration and educational purposes only. It should not be considered as advice or a recommendation to buy or sell any security or financial instrument. We do not and cannot offer investment advice. For further information please read our disclaimer.

![]() To PRINT or save a copy of this lesson in PDF format simply click the PRINT link. This will open the lesson in a PDF format which, you can then PRINT. If you are unfamiliar with PDF or don't have a FREE copy of Arobat Reader see instructions.

To PRINT or save a copy of this lesson in PDF format simply click the PRINT link. This will open the lesson in a PDF format which, you can then PRINT. If you are unfamiliar with PDF or don't have a FREE copy of Arobat Reader see instructions.