Home | Previous | Next Lesson

This Lesson Can Be Printed - See Instructions Below.

High Probability Spikes

Trading spikes in any time frame can be a very high probability trade with low risk relative to reward if our unique set up is followed. Spikes fall under exhaust patterns and signal that the market is ready to reverse.

Traditionally the spike or ''V pattern'' as it is sometimes known will reverse very quickly and is difficult to trade because by the time you identify that it is a Spike it is normally to late.

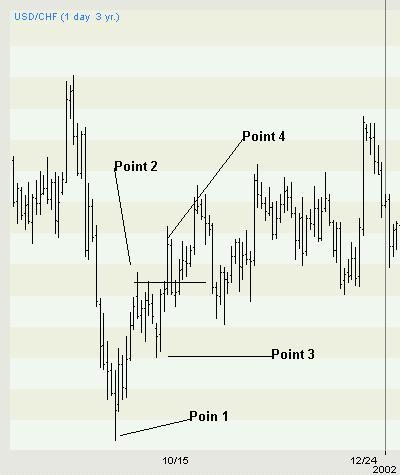

The type of Spikes we will trade will allow us sufficient time to identify the pattern and enter the market with relatively low risk. This requires some patience to let the pattern develop but it will be worth it once you see the results. As with all trades the first thing you are going to do is figure out where you will get out of the trade before you put the trade on. You must always have some kind of money management in place when trading. If you refer to the charts below you will see that there is 4 parts to the spike trade. At point 1 you may or may not see an extended trading range. At point two you may have identified the pattern as a spike. We however wait to confirm that we have a spike until we see the retracement to point 3. This is the set up and we are now ready to trade. |

The breakout happens at point 4. Once we have identified that we have a spike at point 3 we place a sell stop order just below point 4. As soon as the order is hit at point 4 we place our stop loss order just above point 3. This immediately limits your risk. The reverse is true for long trades.

The minimum target I would expect to see would be the distance from point 2 to point 3 extended up or down depending on the direction you are trading. If traded in this manner you can expect as high 75% winners.

You will also notice that this type of trade tends to work quickly. If it is taking a long time to get going (more than three or four bars) after you have entered at point 4 you may wish to lock in any profits and close the trade. Another technique you cam employ is to use a trailing stop and at the first sign that the market might reverse, you can close the position.

Good Trading

Mark McRae

PS. Don't for get to check out our bookstore at http://www.surefire-trading.com/

Information, charts or examples contained in this lesson are for illustration and educational purposes only. It should not be considered as advice or a recommendation to buy or sell any security or financial instrument. We do not and cannot offer investment advice. For further information please read our disclaimer.